Our Health Insurance Focus

Our Insurance Management Solution is designed to cater to the growing requirements of the payer- provider’s ecosystem. This product addresses the needs of end to end insurance processes of HMO, Insurance Company, Health Insurance Broker and Third Party Administrator. With our deep domain expertise, we have also entered the micro insurance market. The Solution is capable of running a large scale UHC project with the capacity to handle multiple insurance schemes on it. We have designed robust fraud detection and prevention system to reduce the leakages in the insurance system.

-

Data Security

We work proactively with information security and have strict processes for handling sensitive information.

-

Easy API Integrations

By integrating us into your internal systems, you remove manual steps and reduce the risks for mistakes.

-

Cloud Based

The system is cloud-based on secure servers in the EU. It holds an uptime of 99,8%

Challenges in Insurance Processes and How our system overcomes these challenges?

Challenges

-

Payer and Provider systems not integrated

-

Prevalence of Fraud

-

Time consuming manual claim processing

-

Lack of analytical tools

Solution

-

Integrated in a unified platform

-

Fraud Prevention measures implemented

-

Auto Claim Processing configuration implemented

-

Analytics dashboard for actionable insights

Key Highlights

Key Highlights of our Insurance Management Product

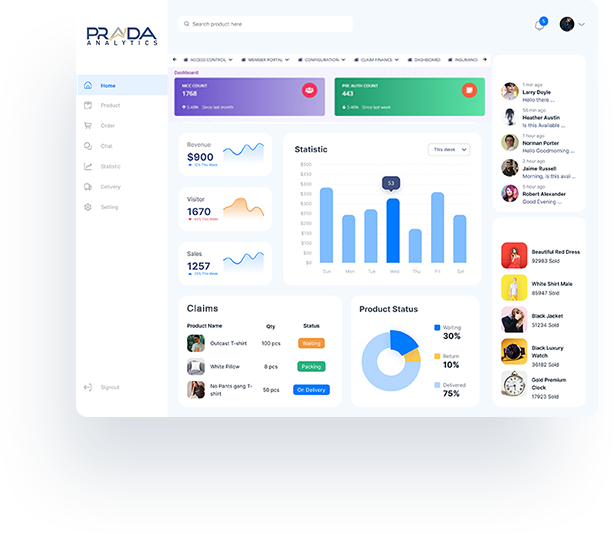

Prada Analytics

Benefits of our Insurance Management Solution

HOSPITAL DESK

-

- Availability of insurance data and tracking

- Authentication/Verification of Insurance Holder using Biometric and OTP.

- Unique MCC Generation, configurable claim code up to 10 digits.

- Preauthorization Submission.

- Provision to attaché documents while Preauthorization & Claim Submission.

- Re-submission of incomplete Preauthorization Claim Submission

- Claim Submission.

- Live Status Tracking of Preauthorization and Claim

- Smart Referral process from one SLA to other SLA

- Tracking of referral clinics and referred patients.

- Reconciliation Statements.

Insurance Company

-

- Complete control on user creation and user role access.

- Provision to create n number of Pre-auth and Claim status in system

- Preauthorization Screening Processing.

- Sending back In-complete Preauthorization to Clinic/Hospital (SLA) to complete and re-submit the Pre-auth.

- Claim Screening at various level (L1, L2, L3 Users).

- Provision to Hold a Pre-auth and Claim.

- Suspected Fraud Management.

- Insurance Scheme and Department wise batch generation and re-conciliation statements

- Batch wise NEFT/EFT files generation for payments of Clinic/Hospital.

- Tracking of Batches and Payments of respective batches.

MIS Reports

-

- Pre-auth Summary

- Claim Summary & Processing Report

- Pre-auth Processing TAT Report

- Pre-auth Deduction Report

- Claim Process Detail Report

- Claim Deduction Report

- Business Summary Report

- MCC Detailed Report

- Biometric Enrolment Report

- Pre-auth Status, Cost, Service Report

- Biometric MCC Detail & Enrolment Detail Report

- Hospital Wise Claim Summary

- Multiple Visit Report

- Biometric Reenrolment Report

English

English